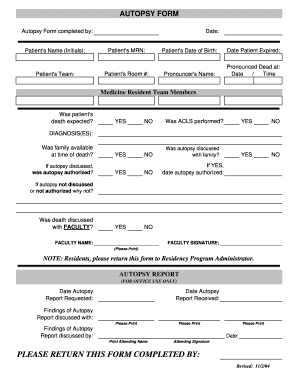

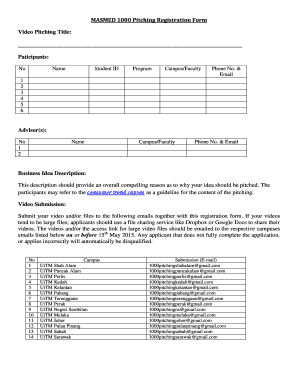

IRS WS CTC 2010-2026 free printable template

Show details

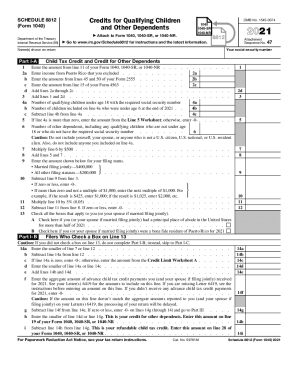

Child Tax Credit Worksheet 2010 Name(s) 1. 2. 3. MICHAEL SWIFT 2 x $1,000. Enter the result. 2 SSN 803-11-0006 1 Number of qualifying children: or Form 1040NR, line 37. 1040 filers. Enter the total

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign credit limit worksheet form

Edit your child tax credit worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit limit worksheet a 2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ctc worksheet online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit limit worksheet a 2024 pdf form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out child tax credit form

How to fill out IRS WS CTC

01

Gather necessary information, including your name, address, and Social Security Number (SSN).

02

Provide details about your qualifying child, including their name, SSN, and date of birth.

03

Indicate whether you are claiming the Child Tax Credit for the tax year by checking the appropriate boxes.

04

Fill in the appropriate income information, ensuring to follow the instructions for specific thresholds.

05

Review the instructions for any additional credits or deductions you may qualify for.

06

Sign and date the form as required.

Who needs IRS WS CTC?

01

Parents or guardians of qualifying children under the age of 17.

02

Taxpayers who have adjusted gross income below certain thresholds.

03

Individuals looking to claim the Child Tax Credit and/or the Additional Child Tax Credit.

Fill

credit limit worksheet a pdf

: Try Risk Free

People Also Ask about child tax credit worksheet and calculator

What is calculated monthly income?

First, find the amount of money you make in a week by multiplying your hourly rate by the number of hours you work in a week. Then, multiply the result by 52, the total number of weeks in a year. Then, divide the result by 12 to learn your monthly gross income. Related: How Does Salary Work?

What should I put for my total income?

Start with the annual salary you earn in your job, minus deductions from your paycheck such as taxes and retirement contributions. You can find this information listed on the tax return you filed last year.

How do I calculate total income?

Your total income is your gross income from all sources less certain deductions, such as expenses, allowances and reliefs. If you are married or in a civil partnership and jointly assessed, your spouse's or civil partner's income is included in total income.

How do I calculate my household income?

Gather all of the gross income of anyone age 15 or older. Make sure you include any type of income, such as wages, tips, bonuses, retirement income, and welfare payments. Social Security benefits, and others. Add these together to get the total household income.

What is counted in household income?

Household income is the adjusted gross income from your tax return plus any excludible foreign earned income and tax-exempt interest you receive during the taxable year.

What is the formula for household income?

Household monthly income per person is calculated by taking the total gross household monthly income [1] divided by the total number of family members [2] living together.

Fill out your IRS WS CTC online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Credit Limit Worksheet A 2024 is not the form you're looking for?Search for another form here.

Keywords relevant to credit limit worksheet a 2023 pdf

Related to credit limit worksheet 2025

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.